15 Mar Baking Manufacturing Trends: Examining the U.S. Market

iba Bakery Trends

On March 15, Robb MacKie, President and CEO, American Bakers Association (ABA) and Kerwin Brown, President and CEO, Baking Equipment Manufacturing Association (BEMA) shared the impacts of COVID-19 on consumers, bakers and suppliers and their predictions for a thriving U.S. commercial baking industry in 2021.

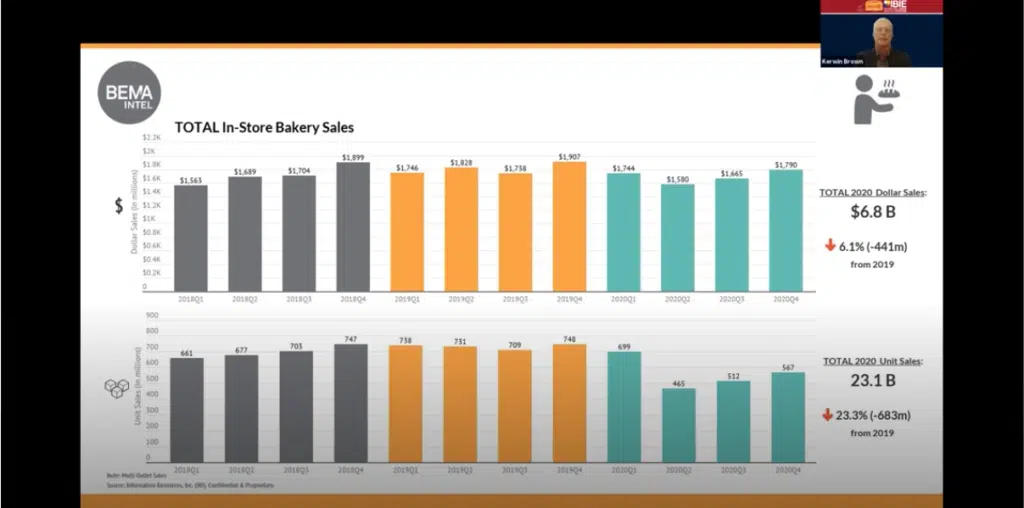

Despite working against overwhelming conditions over the past year, many in the baking industry saw growth in dollar sales and unit sales during all four quarters of 2020. While the grocery center store observed incredible growth and benefitted from consumer panic buying behaviors in Q2, in-store bakery sales showed a marked decrease with fewer opportunities for special events buying and smaller celebrations.

Industry Pulse

A pulse survey conducted by ABA, Sosland Publishing and Lesaffre found grocery doing well as consumers continued to dine at home. Conversely, this resulted in negative numbers in foodservice, although the category is beginning to show signs of a rebound with communities re-opening and more consumers venturing out to dine again. During this time, dollar and drug store numbers remained strong and convenience was mixed. Because of differing state and local rules, outcomes varied by region, state, city and market.

In late 2020, 86% of BEMA’s members shared a positive outlook for the strength of the sector and 2021 in general. This sentiment was echoed by bakers, many of whom expect long-term increased production with decreases on the foodservice side. BEMA’s capital expenditures study also found a positive outlook regarding the U.S. and global markets.

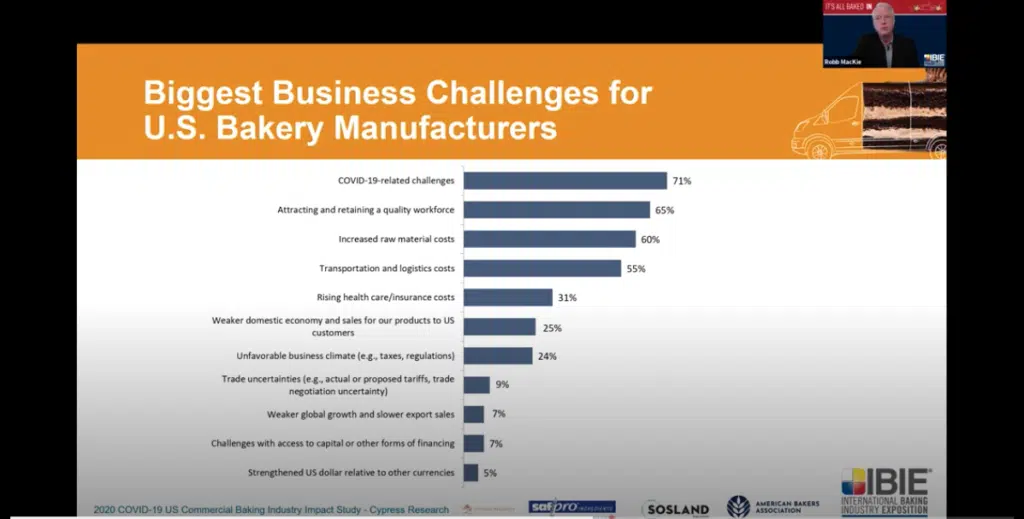

Looking to further capitalize on consumer’s rediscovery of bread, bakers are continuing investments in their businesses. This includes looking for better efficiencies and an ongoing commitment to making dividends. The biggest challenges, beyond the day-to-day management of continuing COVID-related safety issues, are the growing cost of commodities, rising healthcare expenses, supply chain issues and workplace retention. Kerwin and Robb predicted Q1 and Q2 of 2021 will see challenges on the supply chain and the pricing of commodities.

Looking Ahead

With the rediscovery of eating and baking at home, bakers and suppliers will continue their commitment to assist struggling foodservice partners and to use the 2020 learnings to better service customers around the world.

As consumers come back to shopping in-store, it will be important to be ready with the products they love, Robb recommended. Manufacturers will need to home in on food safety, hygiene and packaging to meet consumer needs and allay concerns about the safety of a product.

With labor issues being on ongoing issue, Kerwin recommended that now is the time to automate and bring in more robotics. Robotic additions can help a manufacturer step up to the challenges of creating a cleaner, socially distanced environment and bridge some of the existing employee skills gaps.

In the future, both predict more emphasis on worker safety, vaccine implementation and its side effects and learning how to become nimble and adaptive. Supply chain issues amidst ongoing border closures and restrictions will also be a concern for 2021 and 2022.

About iba Connecting Experts

Taking place March 15-17, the iba Connecting Experts lecture series offers baking industry professionals and their suppliers a global business platform. The three-day kickoff event offers opportunity for connection, discovery, learning and entertainment and will be followed by a subsequent on-site round of business when iba opens its doors live in Munich on Oct. 2021.

No Comments